Chargebacks aren’t just lost revenue, they’re operational risks that can freeze accounts, trigger higher processing fees, or even terminate merchant relationships.

As businesses scale across ecommerce, SaaS, and subscription models, prevention becomes a strategic necessity.

Modern chargeback prevention solutions combine real-time alerts, AI fraud scoring, automated evidence building, and even reimbursement guarantees.

The best solutions don’t just handle disputes reactively, they proactively stop them before they damage your ratios.

This is very crucial for aspiring businesses. Even though you resolve a payment dispute without much trouble, it still raises a flag. That’s why prevention is the way to go.

There was a time when chargeback prevention solutions were rare. The time has changed now, and we have a plethora of options to choose from.

While having more options is good, it also needs some work choosing the best solution for your specific needs. We are going to help you out with that.

Here are the top 5 chargeback prevention solutions for scaling, ranked by effectiveness, automation, and ease of scaling.

A Quick Look at the Best Chargeback Prevention Solutions

1. Chargeback.io: Best Overall Pick

Chargeback.io is built for one mission: stop chargebacks before they happen.

As an official partner with Ethoca and Verifi, it intercepts disputes at the alert stage, instantly refunding or resolving them before they escalate into full chargebacks.

Businesses using Chargeback.io routinely see up to 91% reduction in disputes.

Its lightweight integration (about two minutes with Stripe or Shopify Payments) makes it incredibly accessible even for small teams.

Combined with a flexible pay-per-alert model, it scales smoothly with merchants of every size.

Chargeback.io also offers worldwide coverage, which makes it very suitable for businesses having a global customer base.

Key Features

- Real-time dispute alerts with automated refunds

- Pay-per-alert model (no heavy subscriptions)

- Integration with Stripe, Shopify Payments, Braintree

- Plug-and-play setup in under 2 minutes

- Up to 91% reduction in disputes reported by merchants

- Works across e-commerce, SaaS, and subscription models

- Dedicated customer support with prevention insights

Pros

- Instant prevention drastically reduces disputes

- Budget-friendly and scalable pricing model

- Extremely fast onboarding

- Lightweight, dev-free integration

- Proven dispute reduction rates

- No long-term contract requirements

- Reliable support team

Cons

- No built-in fraud detection

2. Kount

Kount combines fraud detection and dispute prevention into one AI-powered suite.

Its Identity Trust Global Network analyzes billions of interactions to score risk in real time, blocking fraud before it becomes a chargeback.

For disputes that slip through, Kount auto-builds representment packets to streamline recovery.

Its flexible plans, including an Essentials tier with no contracts, make it attractive for scaling businesses testing prevention before committing long-term.

Key Features

- AI/ML risk scoring using billions of data points

- Automated dispute representment packets

- Flexible rules engine to customize fraud thresholds

- Integrations with major PSPs and gateways

Pros

- Strong at preventing fraud-driven chargebacks

- Easy entry with Essentials tier

- Robust automation for fraud + disputes

- Customizable rules for different industries

Pros

- Advanced tiers can be expensive

- Requires ongoing tuning for accuracy

- Complex setup for smaller merchants

3. Signifyd

Signifyd takes a unique approach: liability shift.

If Signifyd approves an order that later becomes a fraud chargeback, it reimburses you for the full amount including shipping and fees.

This gives scaling merchants confidence to approve more borderline orders, boosting revenue while removing downside risk.

With near-instant decisions powered by AI, it also improves checkout flow and reduces false declines, helping merchants capture more good customers without increasing fraud exposure.

Key Features

- Full reimbursement for fraud-related chargebacks

- Real-time order decisions in under 100ms

- Approval rate lift via intelligent AI scoring

- Easy integration with major ecommerce platforms

Pros and Cons

- Eliminates financial risk of fraud chargebacks

- Boosts approvals and preserves revenue

- Fast, seamless checkout experience

- Trusted by enterprise-level merchants

Pros

- Premium pricing model

- Doesn’t cover service-related or friendly fraud disputes

4. Chargebacks911

Chargebacks911 combines prevention with post-dispute recovery.

By integrating real-time alerts with its Intelligent Source Detection™, it classifies disputes by fraud, merchant error, or customer abuse, giving merchants actionable insights.

Its representment service also recovers revenue from disputes that slip through.

It’s widely adopted among global enterprises, supporting 85+ currencies and multiple verticals, from retail to travel.

Key Features

- Ethoca/Verifi alert network integration

- AI-powered dispute source detection

- Full-service representment for recovery

- Supports 85+ currencies worldwide

Pros

- Dual prevention + recovery approach

- Strong global and multi-currency coverage

- Insightful analytics on dispute causes

- High recovery win rates

Cons

- Subscription model can be costly

- No guarantee of full reimbursement

5. ClearSale

ClearSale blends AI with human review to achieve one of the best balances between fraud prevention and approval rates.

Its human analysts step in on borderline cases, drastically reducing false declines that hurt customer experience.

ClearSale also offers a chargeback reimbursement guarantee if they approve an order that later results in a fraud chargeback, they cover the loss.

This safety net gives merchants peace of mind while scaling.

Key Features

- AI + human dual-layer review for accuracy

- Fraud chargeback reimbursement guarantee

- Integrations with Shopify, Magento, BigCommerce

- 24/7 support with tailored onboarding

Pros

- Reduces false declines by up to 80%

- Guarantee removes fraud risk on approved orders

- Easy plug-in setup for ecommerce merchants

- Excellent customer support

Cons

- Manual reviews may slow approval times

- Guarantee excludes non-fraud disputes

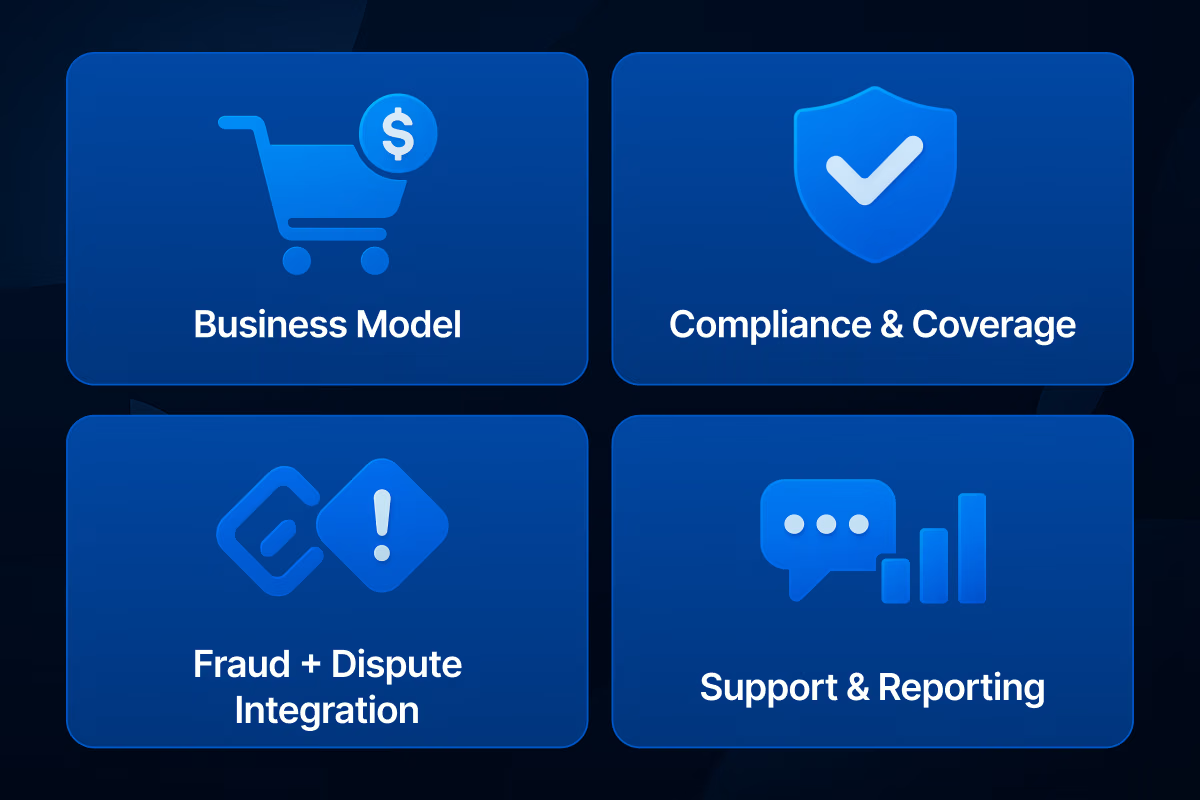

How to Choose the Best Chargeback Prevention Solution

Selecting the right chargeback prevention partner isn’t just about plugging in a tool, it’s about aligning with your business model, transaction patterns, and growth ambitions.

The five factors below are the most important when making that choice.

1. Match to Your Business Model

Not all merchants face the same type of chargeback risk. Subscription-based businesses, for instance, often deal with “friendly fraud” when customers forget recurring billing.

Real-time alerts from providers like Chargeback.io can prevent these from becoming full disputes.

High-volume ecommerce stores, however, may prioritize liability-shift guarantees from Signifyd, where every fraud-related chargeback is reimbursed.

Meanwhile, luxury retailers or high-ticket sellers benefit from ClearSale’s human-AI hybrid approach, which prevents false declines that cost more than the fraud itself.

2. Prioritize Compliance and Coverage

If you operate internationally, compliance and reach matter as much as prevention itself.

Providers such as Chargeback.io are designed for global commerce, supporting worldwide coverage and offering compliance expertise across industries like travel, retail, and digital goods.

Beyond coverage, make sure your provider partners with Visa/Mastercard’s Ethoca and Verifi networks, ensuring disputes are intercepted before they escalate, no matter where your customers are.

3. Balance Cost with ROI

The pricing model you choose can determine whether prevention becomes a cost burden or a growth enabler.

- Per-alert models (e.g., Chargeback.io) work well for smaller or medium merchants, since you only pay when disputes occur.

- Flat subscriptions (like Kount or Chargebacks911) are often better for enterprise merchants handling thousands of transactions daily, as unlimited alerts and bundled features deliver better value at scale.

Understanding your monthly dispute volume will reveal which model saves you more in the long run.

4. Look for Fraud + Dispute Integration

Chargeback prevention works best when combined with fraud detection.

Tools like Kount integrate both layers: they score transactions in real time to block fraud, while also preparing automated dispute responses for cases that slip through.

By combining fraud and chargeback defenses, businesses protect themselves at two stages: before the sale and after the transaction.

It ensures fewer disputes overall and stronger cases in representment.

5. Assess Support and Reporting

Finally, don’t overlook the quality of customer support and reporting. Prevention isn’t only about stopping disputes; it’s also about learning why they happen. P

roviders that offer 24/7 assistance and detailed analytics can help you refine refund policies, improve product descriptions, or adjust billing practices.

Conclusion

Chargeback prevention is no longer optional, it’s a necessity for scaling businesses.

The providers above offer different approaches, from Chargeback.io’s simple, alert-based prevention to Kount’s AI fraud engine, Signifyd’s liability guarantees, Chargebacks911’s global defense, and ClearSale’s human-AI hybrid model.

The best solution depends on your growth stage and vertical. Start by clarifying whether you need real-time prevention, liability protection, or a mix of both, then choose the provider that aligns with your risk profile and customer experience goals.

With the right partner in place, you can protect your revenue, scale with confidence, and keep your focus on growth, not disputes.